🚨 Another research proves Generative AI is lowering demand for junior staff

Generative AI hits junior roles, Tencent beats Google in translation, OpenAI buys Statsig, adds teen controls, while Google doesn't have to sell Chrome

Read time: 12 min

📚 Browse past editions here.

( I publish this newletter daily. Noise-free, actionable, applied-AI developments only).

⚡In today’s Edition (2-Sept-2025):

🚨 Another research proves Generative AI is lowering demand for junior staff, though senior jobs are still secure.

🏆 Tencent’s open-source translation model that beats Google, OpenAI in top global AI competition

🤝 OpenAI announced it will acquire product testing startup Statsig in an all-stock deal worth $1.1 billion.

🔔: OpenAI just announced that it's rolling out parental controls for teen ChatGPT users and routing sensitive chats to reasoning models, with most changes landing over 120 days.

🔒 In a major antitrust ruling today, US judge ordered Google to share portions of its search data with competitors.

🚨 Another research proves Generative AI is lowering demand for junior staff, though senior jobs are still secure.

This new research shows 7.7% junior headcount decline within generative-AI adopters firms by 6 quarters, and 40% fewer junior hires per quarter in wholesale and retail.

They used U.S. résumé and job posting data covering nearly 62 million workers in 285,000 firms (2015–2025).

There's a clear break in timeline of befor ChatGPT and after ChatGPT: before 2022, juniors and seniors grew together, but after generative AI adoption began, seniors kept advancing while juniors fell behind in new hiring.

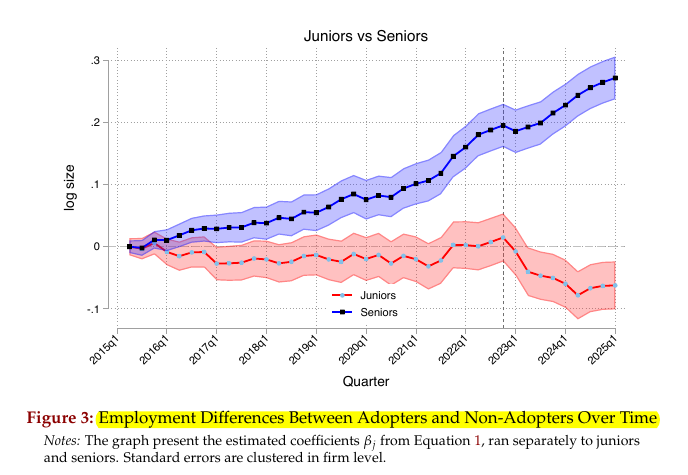

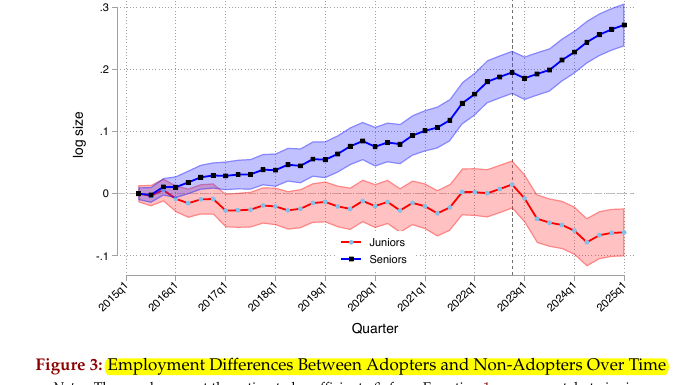

How employment gaps between Gen-AI adopters firms and non-adopters evolve for junior and senior workers.

For seniors, the blue line rises steadily after 2022, meaning that firms adopting generative AI keep growing their senior staff faster than comparable firms that did not adopt.

For juniors, the red line stays flat until early 2022, then begins to fall below zero after 2023, showing that junior employment in adopters weakens compared to non-adopters.

The shaded areas are uncertainty ranges, but the clear split after 2023 shows a sharp divergence, with adopters holding onto or adding seniors, while juniors shrink. So the effect of adoption is not general headcount loss, but specifically a loss of juniors relative to seniors.

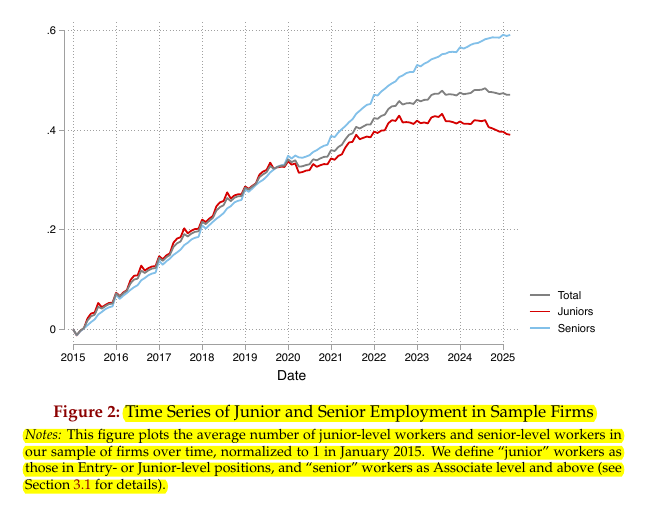

Employment growth over time, split into juniors, seniors, and the total.

There's a clear break before and after 2022. From 2015 through 2021, juniors (red) and seniors (blue) rise almost in parallel, both contributing to steady overall growth (gray).

Starting around 2022, the lines diverge. Senior employment continues climbing strongly, while junior employment stalls and eventually dips after 2023. The total line flattens because the junior slowdown cancels out part of the senior gains. So there's a clear break: before 2022, juniors and seniors grew together, but after generative AI adoption began, seniors kept advancing while juniors fell behind.

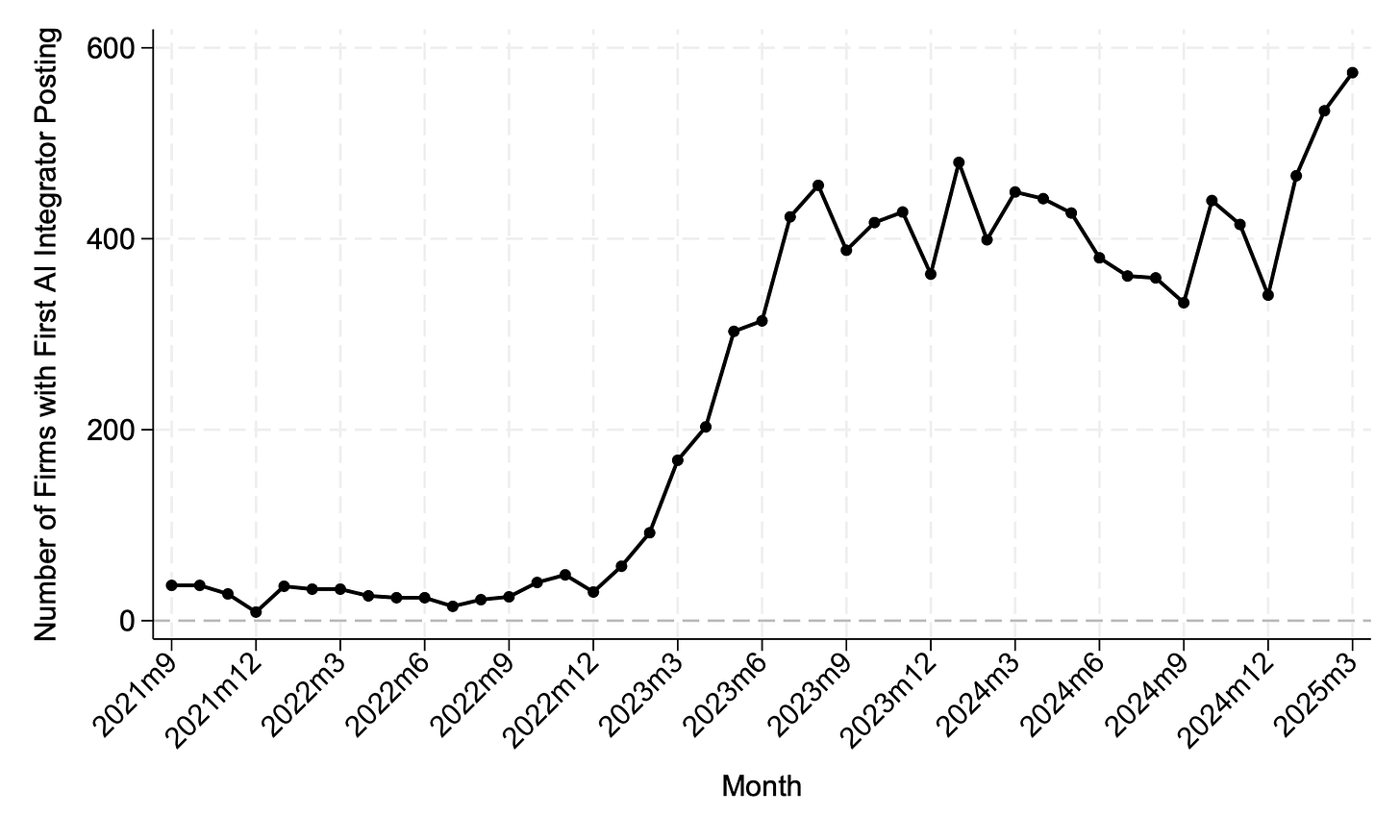

The number of firms each month that post their very first “AI integrator” role.

meaning a job ad explicitly asking someone to connect generative AI systems into workflows. The curve is flat through 2021 and 2022, then shoots up in early 2023, right after the public release of tools like ChatGPT. So thats when adoption really begins.

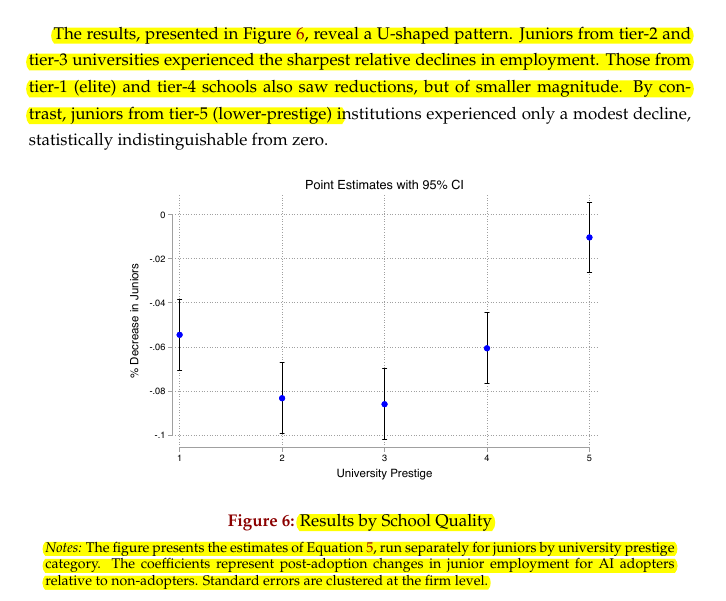

🎓 Gen-AI's effect on junior positions - Who gets squeezed by education tier

The hit to juniors is U‑shaped by school tier, the middle grade Universities sees the largest declines, while elite and lower‑tier grads see smaller moves, and the very lowest tier is near zero.

The salary chart right before adoption shows higher pay for elite grads and much lower pay for the bottom tier, which helps explain why the middle is most replaceable at current costs.

Why the U-shaped effect across school tiers ?

i.e. why the middle tier schools saw the largest decline in their graduates getting hired.

Graduates from elite schools are expensive. Their higher pay makes firms less likely to replace them with generative AI at current performance levels.

These juniors often handle tasks that are complex, client-facing, or high stakes, which AI tools are not yet trusted to fully take over.

At the bottom tier, wages are already low. Replacing them with AI does not generate much savings, so firms may just keep hiring them for routine work.

The middle tiers sit in an awkward spot. Their wages are significantly higher than the lowest tier, but their work tasks are closer to the type of routine or semi-structured work that generative AI can handle. That makes them more cost-effective to substitute.

So the reason the biggest squeeze happens in the middle is that their cost is high enough to invite replacement, but their job functions are not protected by either extreme complexity (like elite grads) or extreme cheapness (like bottom-tier grads).

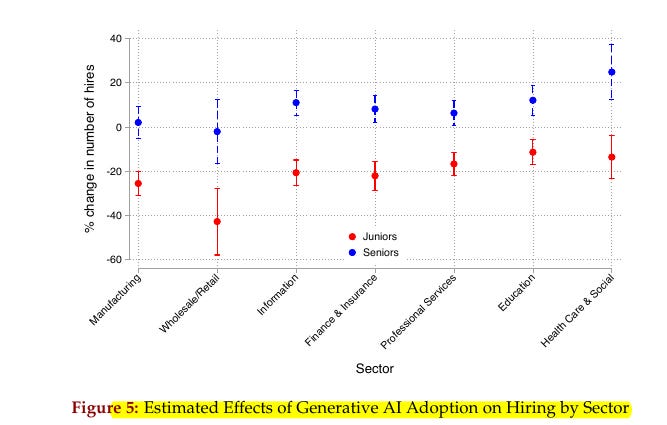

🏭 Gen-AI's effect on junior positions - where it bites hardest across industries

Every major sector shows weaker junior hiring in adopters, but wholesale and retail stands out with about 40% fewer junior hires per quarter.

This lines up with tasks that generative AI can cheaply handle in those settings, like routine customer messages and documentation.

Senior hiring is flat to positive across sectors, which reinforces that the squeeze is concentrated at entry levels.

🏆 Tencent’s open-source translation model that beats Google, OpenAI in top global AI competition

Chinese tech giant Tencent Holdings on Monday released a new open-source translation model that aced a global machine-translation competition despite its small parameter size, highlighting the progress the country has been making in artificial intelligence.

Hunyuan-MT-7B came first in 30 out of the 31 tests in a general machine-translation competition held as part of the coming WMT25 conference. Github.

Supports 33 languages, available on huggingface. Commercial use allowed.

Hunyuan-MT-7B’s strength is that it uses a small number of parameters to deliver results that measure up to or even surpass much larger models. Tencent said its Hunyuan translation model had been employed across a range of in-house products, such as the Zoom-like Tencent Meeting, a web browser and the enterprise version of the WeChat messaging app.

Allowed worldwide except EU, UK, South Korea.

Free license, commercial use allowed.

If >100M MAUs, need special license.

You own your outputs and derivatives.

Cannot use outputs to train other AI models.

Must follow Acceptable Use Policy (no harm, no illegal, no military, no false info, no circumvention).

Must include license notice when distributing.

Must mark modified files clearly.

Tencent trademarks cannot be used for branding.

🤝 OpenAI announced it will acquire product testing startup Statsig in an all-stock deal worth $1.1 billion.

OpenAI continued its spending spree, announcing on Tuesday that it has acquired Statsig, a product development startup, for $1.1 billion. Making it one of the largest purchases in the history of OpenAI.

Founded in 2021, Statsig brings A/B testing and product analytics, which let teams compare 2 versions, track behavior, and ship changes from real usage signals.

For LLM features this means controlled experiments on prompts, safety filters, latency, and cost per request, with automatic rollouts or rollbacks tied to metrics.

Its products have already been used by OpenAI employees as well as by Eventbrite, SoundCloud, and other companies, according to its website.

Earlier this year, Statsig raised $100 million in funding at a $1.1 billion valuation.

Under the agreement, Statsig’s founder and CEO, Vijaye Raji, will join OpenAI as chief technology officer of applications, reporting to Fidji Simo, the former Instacart head who now leads that division.

Simo said Raji will focus on helping companies and developers build “safe applications that empower people” using OpenAI technology.

Other executive roles shuffles

Srinivas Narayanan becomes Chief Technology Officer of B2B Applications, overseeing business products for startups, enterprises, and government, reporting to Chief Operating Officer Brad Lightcap.

Kevin Weil moves to Vice President of AI for Science, partnering with Chief Research Officer Mark Chen, and the ChatGPT product team led by Nick Turley now reports to Simo. OpenAI has stepped up its acquisition activity in 2025, backed by a soaring valuation.

In March-2025, the company secured $40 billion in funding at a $300 billion valuation, and it is now discussing a share sale that could push its valuation to $500 billion.

Other recent deals include a $6.5 billion all-stock purchase of an AI hardware startup co-founded by former Apple design chief Jony Ive. A separate $3 billion deal for coding startup Windsurf was agreed but later collapsed.

🔔: OpenAI just announced that it's rolling out parental controls for teen ChatGPT users and routing sensitive chats to reasoning models, with most changes landing over 120 days.

Parents will get account linking with teens aged 13+, can set age appropriate behavior rules, can turn off memory and chat history, and can receive alerts during a moment of acute distress.

parental notifications that flag when ChatGPT detects "a moment of acute distress,"

A new real time router will switch sensitive conversations to GPT-5 Thinking or o3, models that spend more steps reasoning and are trained to apply safety rules more reliably before replying.

Expert oversight grows through an Expert Council on well being and a Global Physician Network of 250 doctors across 60 countries, with 90 focused on mental health inputs that shape safety research and product defaults.

Parental controls arrive within 1 month, while the wider mental health efforts span 120 days, and users also see in app reminders that suggest breaks during long sessions.

OpenAI explains that "sensitive conversations" will now be moved over to one of the company's reasoning models, like GPT‑5-thinking, to "provide more helpful and beneficial responses, regardless of which model a person first selected."

The distinctive piece here is shifting risk checks from static guardrails to live model routing, plus parent notifications, so escalation happens during the chat instead of after the fact.

But such features have their limitations, experts say, relying on the proactivity and energy of parents rather than that of companies.

Genearlly, AI companies have continued rolling out additional safety guardrails.

Anthropic recently announced that its chatbot Claude would now end potentially harmful and abusive interactions automatically, while the current chat becomes archived, users can still began another conversation. Facing growing criticism.

Meta announced earlier it was limiting its AI avatars for teen users, an interim plan that involves reducing the number of available chatbots and training them not to discuss topics like self-harm, disordered eating, and inappropriate romantic interactions.

🔒 In a major antitrust ruling today, US judge ordered Google to share portions of its search data with competitors.

A federal judge ruled that Google can no longer enter into exclusive distribution deals to make its search engine or its Gemini AI technology the default option on phones and other devices and said Google must share some of its search data with competitors.

But the judge did not grant the US government’s request that Google be forced to sell its popular Chrome browser, which the government said was necessary to remedy Google’s power as a monopoly. Judge said that he would not force the $2.6 trillion company to spin off some of its key assets like the Chrome web browser.

Google keeps Chrome, but exclusive default deals end and it must share search data with rivals. Google can still pay for placement without exclusivity and it plans to appeal, so real changes may take time.

Defaults funnel huge traffic because being the preset in Safari or Android captures queries at the start and starves rivals of data. Data sharing here means handing over user interaction signals like what people click or skip, which help train ranking and answer quality.

Breaking the exclusive loop plus sharing interaction data aims to reduce Google’s scale advantage that compounds through better results attracting more use. The order covers Search, Chrome, Assistant, and Gemini, and forbids tying deals or conditions that force bundling across apps or revenue programs.

Allowing non-exclusive payments means Apple and other distributors can still take money for placement, only now competitors must be free to sit alongside. Expect lots of legal wrangling because Google argues sharing signals risks reverse-engineering and an appeal could slow rollout of any remedy.

To the context, Back in April, a federal judge in Virginia ruled that Google holds a monopoly in certain advertising technologies—the software that marketers rely on to place ads across websites.

Google spends billions every year to be the automatic search engine on browsers like Apple’s Safari and Mozilla’s Firefox. Google paid $26.3 billion for those deals in 2021, according to evidence presented in court.

The prime placement meant more people used Google, which gave it more data to make its search engine better than its competitors’. That advantage allowed it to attract more customers and further elbow out its competitors.

The government wants the court to order Google to spin off part of that system, while Google argues it should only have to adjust internal policies that cemented its power. The judge will decide on remedies during a two-week hearing in September.

Google is also up against another antitrust case in Texas focused on its ad tech business. That lawsuit claims Google kept control at the expense of news publishers who depend on its products to sell ad space.

This is the first major monopoly remedy in the modern internet era, drawing comparisons to the Microsoft case over 20 years ago.

Google plans to appeal, and the legal battle could stretch on for years. The government has tried for years to challenge the dominance of Google, Apple, Amazon, and Meta, accusing them of anticompetitive tactics.

🗞️ Byte-Size Briefs

Apple’s AI-talent Exodus Continues.

💼 Apple just lost its lead robotics AI researcher Jian Zhang to Meta, plus 3 more model engineers to OpenAI and Anthropic

Total 10 recent exits from Apple Intelligence.

Jian Zhang is moving into Meta’s Robotics Studio inside Reality Labs to build products that join model training with control of physical machines.

Apple’s robotics research group stays inside the AI and machine learning division, and it is separate from the robotics product engineering team that shifted under hardware earlier this year.

The other departures are John Peebles and Nan Du to OpenAI and Zhao Meng to Anthropic, and all 3 came from Apple’s Foundation Models team that trains the base models behind Apple Intelligence.

That team has lost roughly 10 people in recent weeks including its chief Ruoming Pang, who left for a multiyear package near $200 million.

Inside Apple there are active talks about using more outside models instead of only in house ones, which would change how features are sourced and shipped across devices.

Meta is investing in an operating system and custom hardware for humanoid robots while also pushing consumer devices like smart glasses, so hiring Zhang strengthens that full stack plan.

Investors are watching execution risk around AI, Apple’s stock briefly dipped 1.5% to $228.77 after the exit news.

Grok Teams has shared its pricing structure:

$30 per seat monthly

$360 per seat annually

Included features:

Support for multiple seats

Tools for admin and billing management

Extended memory capacity of 256,000 tokens

Not launched yet

That’s a wrap for today, see you all tomorrow.

I love the analysis on how juniors are affected by hiring. Clearly, juniors need to get on the AI train, develop their own understanding of the technologies and benefits of applying them, becoming 10x employees. Not getting on the train risks their future