ML Interview Q Series: How can we form business-relevant hypotheses from out-of-stock data and company-level metric observations?

📚 Browse the full ML Interview series here.

Comprehensive Explanation

Analyzing out-of-stock (OOS) inventory for multiple companies often starts with collecting metrics such as average lead times, fill rates, stockout frequency, days of supply, and associated costs. Once these metrics are computed, the core challenge is to formulate logical hypotheses that can drive strategic business decisions. These hypotheses might involve investigating processes that lead to frequent stockouts, relationships between demand surges and inventory planning, the impact of promotions on availability, and seasonality effects. Detailed below are many of the essential considerations that guide the formation of such hypotheses, along with a short exploration of how one might mathematically model certain inventory-related factors.

Understanding Demand Patterns and Seasonality Key questions often revolve around how product demand fluctuates with time. Detecting consistent patterns of high demand during specific seasons, promotional periods, or holidays can help hypothesize that existing inventory controls may be poorly aligned with real demand cycles. For instance, if out-of-stock frequency noticeably increases in the weeks leading up to a major holiday, a hypothesis might be that the company’s demand forecasts are not capturing seasonality adequately.

Quality of Forecasting Models Another hypothesis stems from checking whether the statistical or machine learning models used for demand forecasting are sufficiently robust. In cases where forecast error is systematically high, you can hypothesize that the model overlooks key predictive features (promotional periods, competitor pricing, macroeconomic indicators) or fails to adapt quickly to changing trends.

Supply Chain Bottlenecks If certain companies exhibit recurrent out-of-stock issues tied to delivery schedules or vendor-related disruptions, you can formulate hypotheses around supply chain reliability. These might explore whether ordering lead times are underestimated or whether there is insufficient safety stock to cover unexpected delays.

Promotional Impacts and Cannibalization Promotional events can lead to rapid spikes in demand, causing unforeseen stockouts. A useful hypothesis is that the promotional strategy might be misaligned with inventory availability, or that promotions for one product can cause stockouts for substitute products. A deeper look can uncover hidden correlations between marketing efforts and out-of-stock rates.

Optimal Order Quantities and Reorder Points In many standard inventory management contexts, the Economic Order Quantity (EOQ) framework is used to set an optimal order size that minimizes total inventory costs. This approach considers aspects like fixed setup costs, holding costs, and average demand.

Where:

D is the average demand (in units per time period).

K is the fixed cost of placing an order (sometimes called the setup or ordering cost).

h is the carrying (or holding) cost per unit for the same time period.

Q^* is the optimal order quantity that minimizes total cost.

A hypothesis might be that the company is not following or periodically recalibrating the inventory policy based on updated estimates of these parameters (demand, ordering cost, holding cost). If there are sudden spikes in out-of-stock frequency, it might reveal that actual demand and the average demand input to the model are drifting apart.

Cross-Company Benchmarking If multiple companies are involved, it can be hypothesized that certain best practices used by top-performing companies (in terms of fewer stockouts) can be adopted by others. This hypothesis can be tested by comparing reorder strategies, minimum order quantities, frequency of stock reviews, and demand forecasting techniques.

Advanced Analytics and Machine Learning for OOS Prediction When metrics are tracked at a fine-grained level, one might use time-series models (ARIMA, SARIMA, or neural network-based models) or state-of-the-art libraries like Facebook’s Prophet or Hugging Face Transformers for more complex time-series forecasting. These analyses can trigger hypotheses around whether new data sources (weather, social media trends, competitor behavior) could further reduce stockouts.

import pandas as pd

import numpy as np

from statsmodels.tsa.arima.model import ARIMA

# Example: ARIMA-based approach to forecast out-of-stock risk

df = pd.read_csv('inventory_data.csv')

# Suppose 'sales' column represents demand over time for a given product

# and 'date' is a time-series index

df['date'] = pd.to_datetime(df['date'])

df.set_index('date', inplace=True)

model = ARIMA(df['sales'], order=(1,1,1))

model_fit = model.fit()

forecast = model_fit.forecast(steps=7) # forecasting 7 days ahead

print(forecast)

Such a forecast could be compared against existing stock levels to identify potential out-of-stock risks. If the model consistently underestimates demand, one can hypothesize the model structure is incomplete, or the data used for training is insufficient.

How Seasonal Demand Impacts Metrics

When out-of-stock patterns exhibit strong seasonal components, analysts will often look at historical data to identify cyclical trends. If results show that certain months consistently experience significantly higher stockouts, a hypothesis might be that the organization’s reorder points and safety stocks are not being adjusted to match the seasonal spikes in consumption.

How Supplier Reliability Affects OOS Frequency

If the calculated metrics highlight certain supplier routes that frequently incur longer lead times, a hypothesis arises that a subset of suppliers may be overcommitted or facing logistical constraints. Testing such a hypothesis involves verifying historical records of supplier performance, reviewing shipping times, and exploring the possibility of diversifying suppliers.

Potential Follow-Up Questions

How can you detect that your forecasting model is failing to capture seasonal or promotional spikes?

When measuring forecasting accuracy, you might look for systematic patterns in forecast residuals. For instance, if the forecast error is consistently positive right before a holiday or promotional period, it means actual demand is consistently exceeding forecasts. This indicates the need for additional features in your model—perhaps signals that track upcoming promotions or seasonality patterns. In more advanced ML contexts, you could incorporate exogenous variables or even incorporate state-of-the-art transformer-based time-series models that can more effectively capture complex interactions.

Should one rely solely on historical demand averages to determine reorder policies?

One might start with average demand as a baseline, but this can be dangerously simplistic. If demand is volatile, relying on a single average demand figure often leads to stockouts (in periods of high demand) or overstocking (when demand is low). Safety stock calculations that factor in demand variability and lead time variability are vital. Machine learning techniques can further refine reorder policies by identifying hidden signals—like macroeconomic conditions, marketing budget changes, or competitor pricing—that anticipate shifts in demand.

Why might there be systematic differences in out-of-stock frequencies among different companies?

One hypothesis is that companies differ in supply chain sophistication, where some adopt more advanced forecasting models, collaborative inventory management with suppliers, and real-time point-of-sale data sharing. Another possibility is that certain companies may deliberately maintain a low inventory strategy to reduce holding costs, accepting occasional stockouts. Verifying such differences requires a deep dive into each company’s standard operating procedures, financial constraints, and strategic priorities.

What role does lead time uncertainty play in stockouts?

Lead time is the duration between placing an order with a supplier and receiving the goods into inventory. If lead time is consistently underestimated, even an otherwise adequate reorder policy can result in a high frequency of out-of-stock events. Real lead time uncertainty might come from shipping delays, customs clearances, production bottlenecks, or unforeseen demand spikes at the supplier’s end. A thorough approach would be to add buffer stock or safety time in line with the variability observed in these lead times.

How can external factors like macroeconomic shifts or competitor actions lead to out-of-stock events?

Macroeconomic changes—such as sudden interest rate hikes, political instability, or trade restrictions—can cause disruptions in supply and distribution networks. Competitor actions, such as aggressive marketing campaigns or deep discounts, can shift demand patterns for products in unexpected ways. Incorporating broader economic indicators and competitor intelligence into a forecasting pipeline can help mitigate these external shocks, although complete elimination of unpredictability is rarely feasible.

All these angles highlight the multi-faceted nature of out-of-stock inventory analysis and the hypothesis-generation process. By carefully investigating each hypothesis with data analysis, modeling, and real-world validations, businesses can better align stock levels with true demand, minimize lost sales, and maintain customer satisfaction.

Below are additional follow-up questions

How do you handle supply chain uncertainty when both lead times and demand vary significantly?

One powerful strategy is to incorporate the stochastic nature of both demand and lead times into your inventory models. Traditionally, you might use a safety stock calculation that accounts for variation in demand or variation in lead time in isolation. However, when both are uncertain, the combined variability can be significantly higher than any single source of risk.

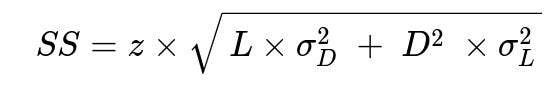

A common approach in a normally distributed demand scenario is to use a formula for safety stock that models demand (with mean D and standard deviation sigma_D) and lead time (with mean L and standard deviation sigma_L). A typical form of the extended safety stock formula is:

Where:

SS (Safety Stock) is the buffer stock level to mitigate stockouts.

z is the z-score from the normal distribution corresponding to a desired service level (e.g., 1.64 for ~95% service level).

D is the average demand per unit time.

sigma_D is the standard deviation of demand per unit time.

L is the average lead time.

sigma_L is the standard deviation of lead time.

By explicitly modeling the variability of both demand and lead times, you reduce the risk of underestimating the required safety stock. A pitfall arises if you assume a simplistic scenario (such as a constant lead time and fixed demand) in a highly volatile supply chain, leading to frequent stockouts or excessive safety stock. Real-world complications include non-normal demand distributions, supply disruptions, or correlated variations (like high demand periods also having extended lead times).

What if certain products have unique lifecycle phases that skew out-of-stock metrics?

Some products may be in a growth phase with rapidly increasing demand, while others could be mature or even in decline. Traditional OOS metrics and reorder calculations rely on relatively stable demand assumptions. If these assumptions are violated, a high-growth product might constantly be understocked, while a product in decline might tie up capital in overstock.

Pitfalls include:

Overfitting a single set of inventory rules across all lifecycle stages.

Misidentifying a short-term demand spike as a long-term trend, leading to excess inventory once demand subsides.

Addressing these issues often involves segmenting products by lifecycle phase (introduction, growth, maturity, decline) and calibrating reorder parameters accordingly. Techniques may also include dynamic reorder policies that update more frequently for products experiencing a high rate of change in demand.

How can dependencies between multiple SKUs or product lines lead to unexpected out-of-stock situations?

Many products exhibit complementary or substitutable relationships. For example, if Product A is out of stock, sales of a close substitute Product B might surge. Alternatively, bundling promotions could cause simultaneous demand spikes across multiple items.

Pitfalls:

Using independent forecasting models for each SKU without accounting for cross-product demand cannibalization or synergy.

Failing to link reorder policies of interdependent items (e.g., a bundling strategy drives up the joint demand, but stock levels are managed in isolation).

A viable approach is to build multi-variate forecasting models that account for cross-product relationships or to run scenario-based simulations. In advanced settings, you might use causal inference methods or graph-based modeling to identify these interactions at scale.

How does brand perception shift when out-of-stock events occur frequently?

Chronic OOS situations can damage brand reputation, potentially leading to customer churn or negative social media sentiment. This impact might be more pronounced for premium brands, where customer expectations around product availability are higher.

Pitfalls:

Overlooking intangible or long-term effects of poor availability, focusing solely on immediate lost sales.

Underestimating how small pockets of negative customer feedback on social channels can snowball into bigger reputational risks.

Companies sometimes develop brand sentiment trackers or social listening pipelines, correlating social sentiment trends with internal inventory and sales data. This correlation might reveal that repeated stockouts for a key product segment coincide with dips in net promoter score or spikes in return rates.

How do you manage out-of-stock risk for short-lifecycle or seasonal products where historical data is limited?

Fashion items, promotional bundles, or seasonal goods often have a short sales window, making it challenging to forecast from past data. Traditional time-series models may be ineffective due to the lack of extensive historical patterns.

Pitfalls:

Relying on aggregate historical data from different but not truly comparable items, which can lead to flawed forecasts.

Missing the narrow window for reorder if the product’s seasonality is extremely short.

A solution includes employing methods like:

Using analogous product data (e.g., last year’s similar style or a close proxy product) and adjusting based on known differences.

Rapid inventory replenishment strategies, including smaller initial orders with quick-turn production or flexible suppliers.

Scenario-based planning, where best-case, worst-case, and expected-case demand estimates shape the stocking strategy.

What if data quality issues are causing incorrect out-of-stock metrics?

Data issues (like inaccurate sales records, improper scanning at checkout, or errors in capturing returns) can distort OOS calculations. If a system mistakenly records negative inventory, or misaligns sales transactions with the correct SKU, the reported stock level may be unreliable.

Pitfalls:

Making key policy decisions (like reorder points) based on faulty data signals, resulting in either large stockouts or surplus.

Failing to detect that data anomalies might be concentrated in specific regions, stores, or product lines.

Addressing data quality requires routine checks on inventory transactions, validation rules for suspicious activity (for example, sudden negative inventory), and consistent reconciliation between physical stock counts and the system’s records. Advanced outlier detection algorithms can also help flag anomalies in near-real-time.

How do you ensure risk management best practices when faced with high-impact, low-frequency events?

In some industries, disruptive events like natural disasters, pandemics, or geopolitical conflicts can trigger abrupt supply chain interruptions. While these are relatively infrequent, their impact can be substantial.

Pitfalls:

Lacking contingency plans or alternate suppliers because it is considered too costly to prepare for events that may never happen.

Overestimating the ability to pivot in real-time once disruption hits, especially if competitor demand surges for the same limited supply sources.

Effective risk management often incorporates scenario planning and stress testing. Companies might maintain buffer capacity or multi-sourcing arrangements to mitigate the single point of failure risk. Simulation tools that replicate shock events can help estimate how quickly and efficiently an inventory system recovers.

How do demand-shaping strategies, such as dynamic pricing or targeted promotions, help mitigate out-of-stock scenarios?

Instead of merely forecasting demand, some companies shape demand by adjusting price points, running promotions at controlled times, or temporarily removing certain SKUs from promotion when inventory is running low.

Pitfalls:

Launching promotions without coordinating with inventory planners, leading to a self-inflicted spike in demand and subsequent stockouts.

Overly aggressive price increases that alienate loyal customers, triggering reputation harm or driving them to competitors.

A balanced approach involves real-time inventory monitoring integrated with dynamic pricing models. When stock is near depletion, a mild price increase or a pause in promotions may spread out demand more evenly. This approach works best when implemented with careful A/B testing to measure elasticity and customer reactions, ensuring you do not erode brand loyalty or hamper long-term sales.