ML Interview Q Series: How would you decide between hiring a customer success manager or offering a free trial for adoption?

📚 Browse the full ML Interview series here.

Comprehensive Explanation

Understanding the Objective The goal is to introduce a new software offering and ensure that customers—whether new or existing—adopt and remain engaged with it. The choice is between investing in a customer success manager (CSM) or relying on a free trial model to drive usage and onboarding. Both strategies have direct cost implications, different effects on customer perception, and varying impacts on the adoption lifecycle.

Customer Success Manager Approach A customer success manager usually provides personalized guidance, training, and onboarding help. This approach can lead to deeper relationships, higher retention, and more effective upselling because customers feel supported. However, it often comes with a higher fixed cost in terms of salary and infrastructure. It may also be harder to scale when the user base expands significantly, unless you build a larger customer success team.

Free Trial Model A free trial allows potential users to experience the product’s value on their own. This can reduce friction in the sales cycle, as customers can try the product before committing. It is often easier to scale compared to a high-touch approach like a CSM. However, it might result in lower usage if the product has a learning curve that isn’t addressed by self-service resources, or if the trial is not well-designed and does not offer enough guidance to help users reach an “aha” moment.

Data-Driven Decision Factors One way to analyze which strategy might yield better results is to investigate customer lifetime value (LTV), customer acquisition cost (CAC), and churn. The ideal approach is to compare how each strategy impacts these metrics.

Estimating Customer Lifetime Value

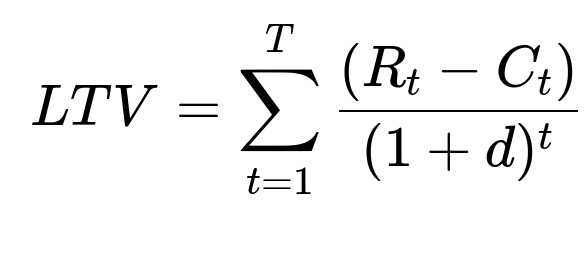

One useful formula for modeling the value that each newly acquired customer brings is the lifetime value formula. A simplified version might be expressed as:

Here, R_{t} is the revenue generated by the customer at time t, C_{t} is the cost associated with servicing the customer at time t, d is the discount rate to account for the time value of money, and T is the length of the customer relationship. Comparing the LTV across different acquisition methods (e.g., free trial vs. CSM) helps quantify the financial return.

In a free trial scenario, there may be minimal incremental C_{t} (such as server or platform usage costs), whereas in a high-touch CSM scenario, the incremental cost might be larger, especially if you need more than one CSM as adoption scales. By estimating LTV, you can project which path to follow if one approach yields a substantially higher net return.

Evaluating Churn and Retention

A high-touch customer success model typically reduces churn because customers receive direct assistance that helps them realize value faster. On the other hand, a well-designed free trial might onboard more users upfront but could also lead to higher churn if new users fail to see immediate value or face usability challenges.

Measuring churn is crucial in deciding between these models. If churn remains high after a free trial, it might be more effective (and ultimately more cost-efficient) to offer personal support that guides customers to full product adoption.

Cost of Acquisition

Hiring a customer success manager is often tied to a higher fixed cost, but can be worthwhile if the increased retention and upselling offset that expense. On the flip side, a free trial might reduce initial friction but offer less direct impact on user engagement if the product is complex or the organization’s branding is still unknown to many potential clients.

A/B Testing and Pilots

It is often beneficial to run smaller-scale experiments or pilots to see how each method performs in practice. For instance, you can offer a controlled user group a free trial, and another segment gets access to a dedicated CSM. By comparing adoption rates, retention metrics, net promoter score (NPS), and overall revenue from each group, you gain data-driven insights into which model works better for your specific user base.

Hybrid Approach

In many real-world scenarios, a hybrid solution might be ideal. This could involve offering a free trial for most users but providing a customer success manager for high-value, high-potential accounts. That way, the resource-intensive, high-touch support can be reserved for strategic customers who are more likely to generate significant returns.

Possible Follow-up Questions

Could you walk through how you would measure success for each approach?

To measure success for each approach, you would track and compare multiple metrics, such as activation rate, retention rate, time-to-first-value, product usage depth, conversion rate from trial to paid (in the free trial scenario), and average revenue per user. Tracking these metrics allows you to see if one method is more effective in driving sustained adoption and long-term revenue.

A key focus is also to assess customer lifetime value for each cohort (CSM-cohort vs. free-trial-cohort) and see which yields higher returns and lower churn. If CSM-led cohorts have significantly lower churn, it might justify the higher personnel cost.

What considerations arise if the product is highly complex?

If the software has a steep learning curve or specialized features that require significant guidance, a free trial might not be sufficient for showing immediate value. Users could become frustrated if they do not quickly grasp the product’s capabilities. In this scenario, a customer success manager or at least a guided onboarding (video tutorials, interactive walkthroughs, quick-start guides) can be crucial to help users navigate the complexity and realize value more promptly.

How would you scale the customer success manager model if user demand grows rapidly?

Scaling a CSM model can become expensive if each customer requires high-touch support. To manage growth, you could tier your customers based on their revenue potential or usage volume, providing direct customer success support only to high-tier accounts. For mid-level or smaller accounts, automated webinars, tutorials, a strong knowledge base, and group Q&A sessions may suffice. Additionally, investing in knowledge-sharing infrastructure can offload some of the day-to-day questions a CSM would normally handle.

How might you design a free trial to maximize conversions?

It can help to carefully time the trial duration so that users have enough time to experience the product's core value without making the trial too long. Clear in-app messaging, interactive walkthroughs, and prompts that highlight key features are effective. For example, once a user completes a certain milestone or experiences a key feature, you can offer an upgrade prompt, highlight success stories, or provide targeted discount offers. The entire funnel from initial sign-up to conversion should have well-defined analytics to measure engagement and identify drop-off points.

What if the product is new and you lack historical data to calculate LTV?

When there is limited historical data, you could use proxy metrics such as shorter-term user engagement, user satisfaction surveys, or initial usage intensity to approximate whether users are on a path to become long-term customers. You might also conduct customer interviews to identify their willingness to pay and primary pain points. Over time, you collect actual usage and churn data to refine your models of LTV.

How could you justify the additional cost of a customer success manager if the budget is tight?

One approach is to show the potential for higher upsells and cross-sells when users are effectively onboarded, along with reduced churn over time. By carefully tracking engagement data, you can demonstrate that investing in a CSM leads to higher retention and possibly expansions of existing accounts. Another justification could be that a dedicated CSM program might provide deeper insights into user needs, which can drive feature improvements and product refinements that boost overall adoption.

In what situations is a free trial alone more appropriate?

A free trial is often more suitable for simpler products that users can quickly learn to use on their own, or where the product’s key value proposition is immediately evident. When your brand is well known or you have a large top-of-funnel audience that wants to test the product in a self-service manner, a free trial can be highly effective. It also works better when budget constraints prohibit scaling a high-touch model and the business model relies on large volumes of customers.

How would you mitigate confounding factors when comparing the two approaches?

External influences, such as seasonal demand or simultaneous marketing campaigns, can bias the comparison. To address this, an A/B test or pilot study should ensure that both cohorts (those with a free trial vs. those with a CSM) are similar in composition (similar user sizes, industries, spending potentials). The test should run during the same time period under similar external conditions. You should also track the same success metrics across groups and ensure randomization when assigning users to either approach.

Final Recommendation Strategy

A sensible way forward would be to run a pilot or A/B test to compare free trial conversions, retention, and revenue metrics to a scenario where a customer success manager is assigned. Examine lifetime value, churn, and acquisition cost across both cohorts. A hybrid strategy could be implemented if data shows that high-value or more complex-use-case clients benefit significantly from personalized help, while the broader market is still well-served by a self-service free trial approach.

Below are additional follow-up questions

How would you handle a situation where a significant number of free trial users sign up but never engage with the product?

One common issue is that people sign up out of curiosity but do not actively use the product. This skews your data and can lead to underestimating the product’s true conversion rates or usage metrics. A practical way to address this is to track engagement signals very early in the trial process. For instance, you might measure activation metrics such as whether a user completed onboarding steps or imported their initial data. Segmenting users based on their level of initial engagement (those who show minimal activity vs. those who consistently use certain features) allows you to refine conversion metrics for “truly engaged” users. You can also automatically send targeted email or in-app nudges to re-engage users who drop off. If these users still fail to convert, you gain insights on which parts of the product or trial experience are not resonating.

One pitfall is failing to distinguish between mere signups and actual usage. This can lead to confusing or inflated top-of-funnel stats. Another edge case is where the user sees the product’s main feature set quickly but doesn’t need to continue using it until a future date, so short-term data might be misleading. In such scenarios, you could lengthen the trial or add a flexible usage-based model, so people have more time to evaluate real value.

What if your product needs specialized domain expertise rather than just usage instructions to see its true value?

Certain products, such as advanced analytics platforms or industry-specific tools, might require domain knowledge to realize their potential benefits. A free trial alone may not be enough for people without that background. In such cases, the presence of a domain-savvy customer success manager or at least specialized onboarding resources can be essential. They can provide context around best practices, data setup, and business processes.

A hidden pitfall here is that the product can appear too difficult or irrelevant to a general audience. If your marketing or product messaging does not clarify the required domain knowledge, prospective users might quit prematurely. You could mitigate this by offering a mini “domain crash course” alongside the trial, or by pairing trial users with a CSM who has relevant industry expertise.

How do you measure the intangible branding effects of a free trial versus a high-touch customer success model?

Certain intangible benefits arise from each approach. A free trial may lead to broader brand awareness as large numbers of people encounter the product with minimal friction. Meanwhile, a high-touch approach fosters deeper relationships that can lead to strong word-of-mouth among a smaller group of highly satisfied users.

Measuring these intangible factors can be done indirectly, for example by tracking referral rates, social media mentions, or user surveys that measure brand perception over time. You might also observe whether free-trial cohorts evolve into “evangelists” who promote the product to others, or if users who interacted with a CSM provide more in-depth testimonials. An edge case: a strong brand ambassador might emerge from a free trial cohort simply because that person discovered the product in a frictionless manner, while a CSM-led approach might produce a more measured but consistent advocacy effect.

How would you handle gathering feedback from large cohorts of free trial users versus a smaller number of CSM-supported customers?

Free trial users can provide broad quantitative feedback—like which features get used most often or where users drop out. You can gather this data at scale, but free-trial feedback may be superficial if users are not heavily invested. The CSM-led group typically offers more nuanced, in-depth qualitative insights because they spend more time exploring the product with guided assistance.

The pitfall is that, if you only rely on free-trial users, you risk making product decisions based on relatively light or incomplete usage patterns. Conversely, if you rely heavily on CSM-led feedback, you might over-optimize for the needs of high-touch clients while ignoring the simpler workflows used by smaller or self-serve customers. A balanced approach is to collect both macro-level usage data from the free trials and detailed user stories from the CSM-led clients, triangulating these insights for a more holistic view of product improvements.

How would you adapt if the user base is highly variable in technical skill or domain familiarity?

When you have a wide range of users—some being tech-savvy early adopters and others who are new to digital tools—you can segment your onboarding strategy. For the self-sufficient, tech-savvy segment, a free trial might suffice because they can easily explore features independently. For users who struggle with new software or have less domain expertise, personalized guidance via a CSM or specialized onboarding materials can be critical.

A possible pitfall is creating a “one-size-fits-all” approach that either overwhelms advanced users with too much handholding or leaves less advanced users behind because the self-serve resources are too sparse. One way to mitigate this is to embed a short questionnaire during signup to gauge the user’s background or goals. Depending on their answers, you route them to the best-fit onboarding path.

What compliance or legal factors might influence the decision between a free trial and a CSM-led approach?

In industries with strict regulations—such as healthcare or finance—onboarding might require thorough checks for compliance, security, data privacy, or licensing. A simple free trial might be complicated by the need to sign legal agreements or demonstrate compliance readiness. In such contexts, a more consultative, CSM-led approach can ensure that prospective clients complete any necessary documentation or security reviews.

A subtle edge case is when you have certain data-handling requirements that must be tested even in a trial environment. If users sign up freely and start uploading sensitive data, you could run into compliance issues if you haven’t verified their eligibility or properly explained data handling obligations. A CSM approach, or at least a more guided trial sign-up, can reduce this risk by ensuring new users understand the regulatory context.

Could you tailor the free trial experience by user segment so each group sees the most relevant features?

Yes, you can create segmented or personalized onboarding flows, leading new signups through use-case-specific “mini tours” of relevant product areas. For example, an e-commerce retailer might see recommended modules for payment integrations and inventory, while a freelancer might get a streamlined version focusing on invoicing.

A pitfall is that segmentation can become too granular, resulting in maintenance overhead if you end up building many different “micro-free-trials” that you cannot manage or track effectively. Another subtlety is that incorrectly segmenting a user might hide features they actually need. Therefore, the product must allow easy switching between different guided paths or provide an option to explore features outside the recommended track.

Does a higher-priced product push you more strongly toward a customer success model?

Higher-priced or enterprise-grade offerings typically have more complex features, deeper integrations, and higher stakes for the buyer, meaning a dedicated CSM approach can be more compelling. The customer expects personalized attention when making a big purchase, so a high-touch relationship can shorten the sales cycle by addressing concerns and customizing onboarding.

An edge case is if your higher-priced product still has a straightforward value proposition and minimal complexity. In that scenario, a time-limited or usage-limited free trial may still be sufficient to demonstrate value. However, even in that case, you may need some human-led consultative layer for enterprise-level security or procurement requirements.

How do you integrate or combine both approaches for large enterprise clients?

In some situations, a free trial might serve as an initial hook: the enterprise can test the software’s basic functionality and user interface. Once they see promise, a dedicated CSM steps in to conduct advanced proof-of-concept deployments, handle custom integrations, and provide specialized training to enterprise stakeholders.

One pitfall is that large clients might dismiss the free trial as “too simple” and not reflective of their needs, leading them to underestimate the product’s capabilities. To address this, you could offer a multi-phase approach—an initial free trial sandbox for exploration, followed by a guided pilot with direct involvement from a CSM for deeper integrations. Another subtlety arises in transferring trial data to a production environment. If the user invests time configuring the trial environment, ensure that the transition to the full paid environment is seamless to avoid duplication of work.

How do you handle potential cannibalization of paid services by offering a free trial?

If you already have a paid onboarding service or paid consultation package, introducing a free trial might cannibalize some of that revenue. You would have to carefully separate what is included in the free trial from the premium support or advanced features in the paid tier. A good strategy is to limit the free trial to essential or core features, while advanced functionalities remain behind a paywall or come with professional services fees.

A hidden pitfall is that limiting a free trial too aggressively can discourage serious customers from fully evaluating the solution, which might reduce conversions. Conversely, being too generous might erode the paid services. Achieving the right balance often requires iteratively testing the boundaries of which features to open up during the trial period.