ML Interview Q Series: How would you determine the value of renewing a popular sitcom’s license on Netflix?

📚 Browse the full ML Interview series here.

Comprehensive Explanation

A helpful way to value the benefit of retaining a show on a streaming platform involves analyzing both quantitative and qualitative factors. The key quantitative component is typically the extent to which this show affects subscriber retention, acquisition, and overall viewership engagement. The qualitative side looks at brand value, synergy with original content, and potential marketing impact. Below is an in-depth discussion of these components.

Data-Driven Subscriber Impact

One of the foundational ways to assess the value of a show is to see how it drives or maintains subscriptions:

Subscriber Retention: Track how many users might cancel (churn) if the show disappears. This can be estimated using historical data on user behavior and watch patterns. If subscribers who frequently watch this sitcom are the ones more likely to churn after it is removed, it suggests a strong effect on retention.

Subscriber Acquisition: Evaluate how many new subscribers specifically signed up (or stayed subscribed) to watch this show. If marketing data or user surveys show that a significant proportion of new subscribers joined for this content, then that is a measurable benefit.

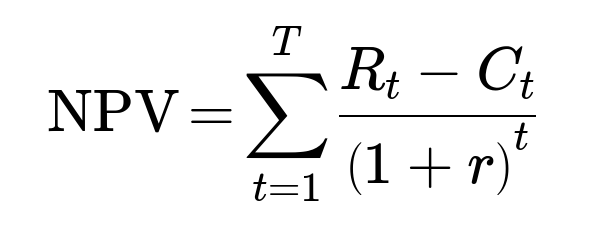

Modeling the Value with Net Present Value (NPV)

A common financial approach to valuation is to estimate the Net Present Value (NPV) of future cash flows associated with retaining the show. You project the incremental revenue generated by having the show and subtract any associated costs (e.g., licensing fees, marketing costs), then discount these cash flows over the contract period.

Where:

R_{t} is the additional revenue at time t from subscribers who stay or join specifically for this show (this might be estimated by a fraction of their subscription fee or average revenue per user).

C_{t} is the licensing fee and any other direct costs related to the show at time t.

r is the chosen discount rate reflecting the time value of money and risks involved.

T is the total number of time periods (e.g., years or quarters) you are evaluating.

Calculating Incremental User Engagement

A show’s real value often comes from user engagement. If viewers who come for this show end up exploring a lot of other titles, the platform may benefit from deeper engagement metrics. This can translate to reduced churn because highly engaged customers are usually less likely to cancel. Specifically:

Track average watch-time and session frequency changes after the show’s arrival.

Look at cross-title correlations to see if fans of this show tend to watch other titles, boosting overall platform usage.

Additional Qualitative Factors

Brand and Market Positioning: If the show is emblematic of a certain era or cultural phenomenon, having it available can bolster Netflix’s brand perception.

Synergy with Original Content: Some shows attract viewers who discover other Netflix originals, thereby indirectly raising the profile and success of those original programs.

Competition: If competitor platforms do not have this show, retaining it might confer an exclusive advantage that differentiates Netflix.

Example of a Basic Python Approach to Model Churn

Below is an illustrative Python snippet (though highly simplified) showing how one might use engagement data to model churn rates among viewers. In practice, one would incorporate more sophisticated modeling techniques, but this snippet outlines the rough idea.

import pandas as pd

import numpy as np

from sklearn.linear_model import LogisticRegression

# Suppose we have a DataFrame with columns:

# 'user_id', 'watched_show' (boolean), 'watch_hours', 'churned' (boolean)

data = pd.read_csv('user_watch_data.csv')

# Prepare features and labels

X = data[['watched_show', 'watch_hours']]

y = data['churned'].astype(int)

# Train a logistic regression model

model = LogisticRegression()

model.fit(X, y)

# Coefficients indicate how 'watched_show' correlates with churn

coeffs = model.coef_

print("Coefficients:", coeffs)

# Predict churn probability for a new user (example)

new_user = np.array([[1, 20]]) # watched_show=1, watch_hours=20

predicted_churn_prob = model.predict_proba(new_user)[0][1]

print("Predicted churn probability for someone who watches the show a lot:", predicted_churn_prob)

With such a model, you can compare churn probability between those who watch the show heavily and those who do not. The difference helps you quantify the impact on churn. This in turn feeds into R_{t} (incremental revenue) in the NPV formula.

How might you isolate the effect of this specific show from other popular titles that are also on Netflix?

You can apply techniques such as difference-in-differences analysis or quasi-experimental designs. In a difference-in-differences approach, you might compare churn or viewership changes among a control group of subscribers who are not interested in the show versus a treatment group that is highly interested in it. By analyzing the divergence in these behaviors before and after the show’s availability (or removal), you approximate the unique contribution of that show.

You can also use user-level watch data to segment the population according to watch times for this show and for other shows. If you see a distinct drop in retention only in the segment tied to this show, that indicates a strong incremental effect.

What if data suggests the show is losing popularity?

Even if popularity is declining, there could still be core loyal fans who would churn if the show disappeared. The executive team might consider:

Reducing the licensing renewal cost or adjusting the contract term if the popularity downward trend is evident.

Investigating alternative shows or original content that serve the same audience to maintain engagement if you decide not to renew.

Examining whether a short-term renewal is more beneficial as a bridge for a new replacement show.

Could competitor platforms or external factors affect valuation?

Yes, external factors can play a significant role in the strategic assessment:

If a major competitor obtains the show, it might draw away a slice of Netflix’s user base. This potential impact can influence the “cost” (in terms of subscriber churn) of losing the show.

Economic shifts and changes in user spending habits can alter the baseline churn rates, so you might adjust your discount rate r in the NPV calculation to account for market uncertainties.

Licensing negotiations often involve clauses around exclusivity, promotional support, or marketing tie-ins. These intangible components can affect how the show’s perceived value translates into user retention and acquisition.

How would you deal with incomplete or uncertain data while doing these estimates?

Employ scenario analysis: Construct optimistic, baseline, and pessimistic scenarios for R_{t} and churn impact, then compute NPV for each scenario.

Use Bayesian approaches or confidence intervals to express uncertainty around key parameters, such as the expected incremental subscriber count, churn reduction, or changes in watch time.

Continuously update models with real-time data to refine estimates of subscriber retention and user engagement, ensuring that negotiations are guided by the most recent, relevant information.

Below are additional follow-up questions

How might the show’s presence drive intangible brand benefits, and how can we account for that in the valuation?

One subtle challenge in valuing a popular sitcom is the intangible brand lift it can bring to Netflix. Traditional NPV analyses focus on subscriber counts and revenue streams, but a show that resonates deeply with cultural and nostalgic sentiments can enhance the platform’s public perception and brand equity. Although brand equity is harder to quantify, you could use the following approaches:

Brand Surveys and Sentiment Analysis: Send out surveys to subscribers or use social media monitoring (e.g., scanning tweets and online forums) to identify positive or negative sentiments directly tied to the show.

Correlative Trends: Track any uptick in brand mentions or positive press coverage around Netflix’s retention of marquee content. Correlate the timing of these mentions with changes in user engagement or subscriber growth.

Adoption in Key Demographics: If the show has particular cultural or generational appeal, it might strengthen Netflix’s position among specific audience segments. You can measure the incremental improvement in brand perception or Net Promoter Score for these segments.

A potential pitfall is overestimating how much brand value stems from a single piece of licensed content. Unless you have reliable historical data, it can be easy to assume a larger brand impact than actually exists. Also, brand value is often built from multiple high-impact shows rather than just one, so attributing intangible benefits must consider the entire content library.

When negotiations indicate the licensing cost is higher than your valuation, how might you strategize?

If you determine the show’s value is lower than the licensing fee demanded, you can employ several strategies:

Bundling or Portfolio Negotiation: Offer to license multiple shows or related spinoffs from the same network, spreading the cost over a bigger portfolio. This could make the overall deal more attractive without overpaying for one specific show.

Shorter-Term Contracts: Negotiate a shorter renewal period or performance-based terms. For example, link part of the licensing fee to actual engagement metrics. If the show’s performance declines, Netflix pays less, mitigating the risk of an overestimation.

Data-Driven Counterproposals: Present concrete user engagement statistics and churn modeling to show exactly how you derived a lower valuation. This data-driven approach might prompt more realistic pricing from content owners.

One edge case is if the content owner has strong leverage (e.g., the show is a cultural phenomenon). In such scenarios, Netflix must weigh the risk of losing subscribers and brand equity against overpaying. Another subtle pitfall is that even with successful negotiation tactics, the final deal might still strain your content budget if the competition for that show is intense.

If the show is part of a larger content package, how can you isolate its individual value?

Often, content is bundled in multi-show deals. You can approach the valuation by:

Attribution Models: Allocate the overall cost based on factors such as historical streaming hours, predicted churn impact, or distinct fan base sizes for each show in the bundle.

Incremental Analysis: Compute the deal value with and without the particular show (in hypothetical scenarios) to see how the presence or absence of that one show shifts retention rates or user engagement. This approach uses scenario-based modeling.

Negotiation Leverage: If you realize that one less popular show in the package is inflating costs, you could negotiate removing or reducing that portion. Alternatively, if your data shows a different show is actually more pivotal for retention, the “hit sitcom” might be less critical than the network assumes.

The tricky part is that subscriber decisions aren’t typically driven by just one show. Customers often watch multiple titles, so you risk attributing too much or too little value to a single sitcom if you don’t carefully parse out watch behaviors.

How would shared or family accounts complicate the measurement of a single show’s engagement or churn impact?

Many Netflix accounts are shared among multiple users under one subscription. This complicates the attribution of engagement metrics because:

Inconsistent Profile Usage: Some families may not consistently use separate profiles, so watch history for the sitcom might blend with other household members’ behaviors.

Varied Interests: One family member might be the only one interested in the sitcom, while others rarely watch it. If that single user threatens to unsubscribe (or switch services) without the show, it still results in the entire household account churning.

Partial Overlaps: Another possibility is that the household stays because other members still enjoy different content, masking the churn risk even if the sitcom watcher loses interest.

To handle this, you could analyze micro-level engagement signals. For instance, if multiple profiles exist, you can separate watch times. If profiles are not reliably used, you may rely on time of day or device usage patterns to infer which household member is watching. You also may take a more holistic approach and treat a household as a single decision unit, focusing on the strongest driver of retention within that unit.

Could there be significant synergies with Netflix originals or other titles that increase the show’s indirect value?

Some non-original shows serve as “gateway” content that introduces users to the platform’s interface and content library. If this sitcom frequently leads to recommendations of Netflix originals that users then watch (and enjoy), it effectively boosts the perceived value of Netflix originals, too:

Recommendation Path Analysis: Track whether viewers who watch this sitcom subsequently watch recommended Netflix originals (or other licensed shows). If you observe a high conversion rate into Netflix’s proprietary content, you can factor this synergy into the show’s valuation by attributing part of the original’s success to that funnel.

Cross-Promotional Campaigns: If Netflix chooses to market a spin-off or thematically related original alongside the sitcom, the older show can serve as a strong anchor, drawing fans into new content.

Potential Pitfalls: Overestimating synergy is easy if your recommendation engine is robust but fans simply ignore the new titles. You also risk conflating correlation with causation. Users might watch the recommended original for reasons unrelated to the sitcom (like star power or social media buzz).

What if the deal includes potential spin-offs or sequel series?

Sometimes, the deal could encompass future expansions of the universe. This requires an element of speculative valuation:

Option Value: If a sequel or spin-off might become available under the same contract, you should account for the “option value” of acquiring that content without incurring new negotiations. This could be embedded in your licensing fee estimates.

Production Timeline and Likelihood: Evaluate how likely the spin-off is to actually happen. If the studio has already announced production, you might assign a higher probability to the show coming to fruition. If it’s just an idea, you might assign a lower chance or a discounted cash flow in your model.

Synergy with the Existing Fan Base: A spin-off could rejuvenate interest in the original show, causing a spike in streaming hours or new sign-ups. However, an unappealing spin-off might fail to retain viewers or even tarnish the brand if it’s poorly received.

A pitfall is to pay a premium for possible spin-offs that never occur or underperform. Continual reevaluation is key as new information—such as confirmed cast or storyline—becomes available.

How do you factor in cross-regional differences in popularity and licensing restrictions?

The sitcom’s popularity might vary dramatically across different countries or regions. This complicates valuation since licensing fees often scale with geographic reach:

Segmentation by Region: Build models for each major region (e.g., North America, Europe, Asia), factoring in unique content preferences, local competition, and ARPU (Average Revenue per User) differences.

Localized Market Conditions: In certain markets, the show may have near-cult status and substantially drive subscriber retention, whereas in others it may have minimal impact. Adjust your churn reduction assumptions accordingly.

Legal and Distribution Complexities: Some regions might have separate contracts or partial exclusivity arrangements. If you can’t get full exclusive rights, the show’s relative value may be lower because local competition also streams it.

One subtlety is that a show with moderate popularity across many global regions can collectively have a massive total effect. Conversely, a show beloved only in one or two regions might not justify a global licensing fee. You must weigh the cost structure to avoid overspending in markets where the show barely resonates.

Could marketing campaigns or adverse media coverage drastically alter the show’s perceived value in a short time?

Yes. A show’s value can be dynamic, influenced by external events:

Surge in Popularity: A reunion special or anniversary event can suddenly spike user interest, increasing watch hours and even winning new subscribers. You could incorporate real-time metrics into your model to capture these short-term surges, then evaluate their durability.

Controversies or Cast Issues: Negative headlines involving the cast or the show’s creators might reduce its appeal. Monitor social media sentiment, churn patterns, and streaming declines to see if the controversy actually impacts numbers.

Market Overreactions: Both spikes and dips can be temporary. A one-time boost from a media campaign might not imply long-term retention improvements, so it’s vital to separate transient marketing “blips” from sustained subscriber gains.

A pitfall is locking into a long-term licensing agreement based on a short-term uptick in popularity, or similarly, giving up a show too quickly if a temporary controversy deflates its metrics. Continual data tracking is essential to differentiate permanent trends from momentary anomalies.